Our Thomas Insurance Advisors Statements

Wiki Article

Thomas Insurance Advisors Can Be Fun For Anyone

Table of ContentsOur Thomas Insurance Advisors StatementsIndicators on Thomas Insurance Advisors You Need To KnowWhat Does Thomas Insurance Advisors Do?Rumored Buzz on Thomas Insurance AdvisorsThomas Insurance Advisors Fundamentals Explained

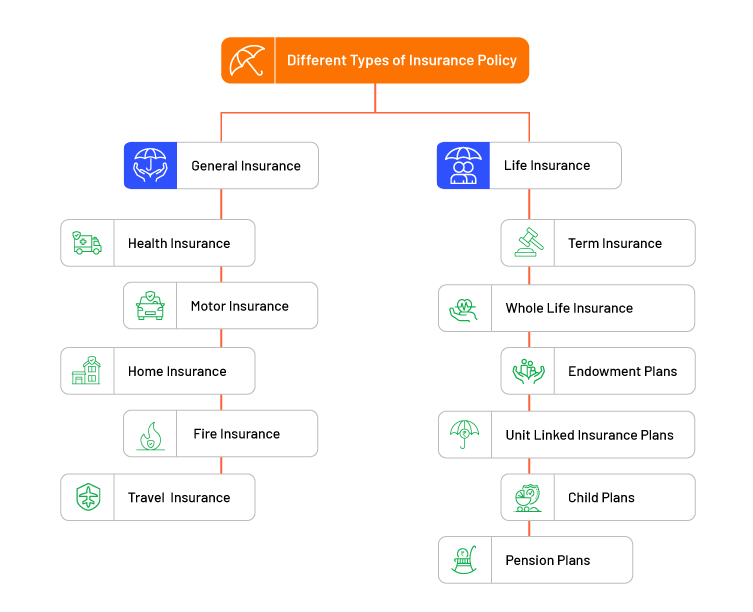

The money worth element makes whole life more complicated than term life due to charges, taxes, rate of interest, as well as other stipulations. Universal life insurance coverage is a versatile long-term life insurance policy that lets you lower or increase just how much you pay toward your regular monthly or yearly costs over time. If you decrease just how much you invest in premiums, the distinction is taken out from your policy's cash value.An universal plan can be a lot more expensive and also difficult than a standard entire life policy, specifically as you age and also your costs enhance (https://www.wattpad.com/user/jstinsurance1). Best for: High income earners who are attempting to develop a nest egg without getting in a higher earnings bracket. Just how it works: Universal life insurance policy allows you to change your costs and survivor benefit relying on your needs.

All about Thomas Insurance Advisors

Pro: Gains possible variable plans might earn more interest than traditional whole life. Disadvantage: Financial investment risk potential for shedding cash if the funds you chose underperform. Final expense insurance, additionally referred to as funeral insurance policy, is a kind of life insurance policy designed to pay a small survivor benefit to your family to help cover end-of-life expenses.

Due to its high prices as well as reduced protection quantities, last cost insurance policy is normally not as excellent a value as term life insurance. Best for: People that have difficulty qualifying for conventional insurance coverage, like seniors and also people with significant health and wellness conditions. How it functions: Unlike most standard policies that require a medical examination, you only require to respond to a couple of questions to receive final cost insurance policy.

Thomas Insurance Advisors Can Be Fun For Anyone

Pro: Assured insurance coverage very easy access to a tiny advantage to cover end-of-life costs, including medical bills, burial or cremation solutions, as well as coffins or urns. Disadvantage: Cost costly premiums for reduced protection quantities. The ideal means to select the policy that's best for you is to chat with an economic expert as well as deal with an independent broker to find the right plan for your certain requirements.Term life insurance policy policies are generally the ideal remedy for individuals who require budget friendly life insurance policy for a certain period in their life (https://www.taringa.net/jstinsurance1/insurance-in-toccoa-ga-thomas-insurance-advisors-leading-the-way_59ch99). If your goal is to provide a safeguard for your family if they needed to live without your revenue or contributions to the family members, term life is likely a great suitable for you.

If you're already maximizing contributions to traditional tax-advantaged accounts like a 401(k) as well as Roth individual retirement account and desire an additional financial investment vehicle, long-term life insurance policy can benefit you. Final expenditure insurance can be a choice for individuals who might not have the ability to obtain insured otherwise as a result of age or major health conditions, or elderly customers that don't want to problem their family members with funeral expenses."The ideal kind of life insurance coverage for every individual is entirely reliant on their individual circumstance," claims Patrick Hanzel, a qualified financial planner and also progressed preparation supervisor at Policygenius.

The Best Strategy To Use For Thomas Insurance Advisors

A number of these life insurance alternatives are subtypes of those included over, meant to offer a particular objective, or they are specified by how their application procedure also referred to as underwriting jobs - https://profile.hatena.ne.jp/jstinsurance1/. By kind of coverage, By sort of underwriting Team life insurance, likewise called group term life insurance policy, is one life insurance policy contract that covers a group of people.Team term life insurance is usually subsidized by the insurance policy holder (e. g., your company), so you pay little or none of the policy's premiums. You get protection approximately a restriction, typically $50,000 or one to two times your yearly wage. Team life insurance policy is affordable and also easy to certify for, however it seldom supplies the degree of insurance coverage you could require and you'll probably shed coverage if you leave your job.

Best for: Any person who's offered team life insurance by their employer. Pro: Convenience group policies supply ensured protection at little or no expense to employees.

Thomas Insurance Advisors Can Be Fun For Everyone

With an MPI policy, the recipient is the here home mortgage company or lending institution, as opposed to your household, and also the survivor benefit reduces with time as you make mortgage repayments, comparable to a lowering term life insurance policy policy. Purchasing a conventional term policy rather is a far better selection. Best for: Anyone with home loan obligations who's not eligible for standard life insurance policy.The plan is linked to a single financial obligation, such as a mortgage or business lending.

You're guaranteed approval as well as, as you pay down your lending, the death advantage of your policy decreases. Commercial Insurance in Toccoa, GA. If you pass away while the plan is in pressure, your insurance supplier pays the fatality benefit to your loan provider. Home loan protection insurance policy (MPI) is among one of the most common sorts of credit scores life insurance policy.

Report this wiki page